9 Creative Ways to Use Azibo for Rent Collection

While many landlords use Azibo for residential real estate, you can also use it to collect rent on office space, restaurants, hair salons, storage units, and more.

While many landlords use Azibo for residential real estate, the platform can be used for a variety of rent collection needs. In this article, we’ll share how other rental businesses use Azibo, as well as key features to help you save time and stay organized.

What is Azibo?

Azibo is a free, one-stop-shop for managing rental property finances. The platform includes tools for online rent collection, banking, expense management, and tenant screening, as well as access to insurance and loans to run your business.

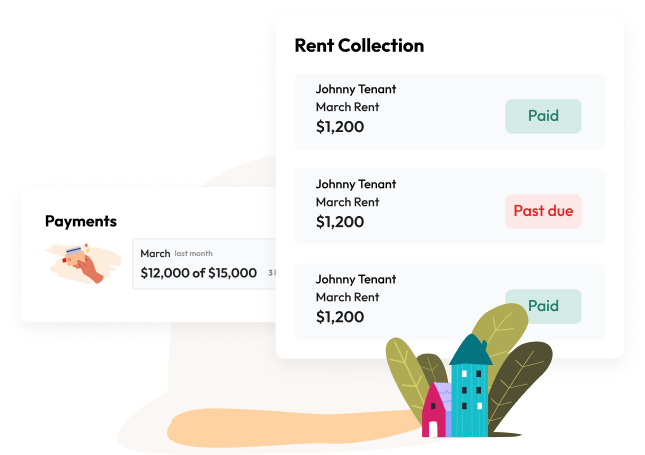

Azibo aims to simplify rent collection by offering secure online payments and fast payouts. Rental business owners also find value in our key features, including:

- Flexible payment methods: Enable renters to choose from multiple online payment methods including credit card, debit card, and ACH bank transfer.

- View real-time payment status: Our rent dashboard helps you view renter payments in one place so you can instantly see who paid and who hasn’t.

- Simplify tax prep: Tag expenses by property and Schedule E category to save time and stay organized ahead of tax season.

Not just for residential rental property owners

Azibo works for many types of rental businesses besides residential real estate. Here are just a few examples of additional uses for Azibo’s rent collection platform:

- Office space (e.g., buildings, rooms, or even individual desks)

- Commercial buildings (e.g., retailers and restaurants)

- Storage units

- Parking spaces

- Salon chairs (e.g. for hairstylists, makeup artists, or manicurists)

- Billboards

- Tractors and trailers

- Horse stables

- Camping sites

How Azibo helps rental business owners be successful

In addition to the tools and benefits listed earlier, we have several features built specifically for business owners who use Azibo for rentals that are not residential properties.

1. Stay organized with portfolios

If you rent out multiple units under one business (e.g., multiple trucks in a fleet, or office space in multiple buildings), you can stay organized by creating a portfolio in Azibo. Once you’ve created and named your portfolio, you can add as many units or properties as you need. Within the portfolio, you can assign different bank accounts to different properties, and during tax season, you’ll be able to tag all income and expenses.

2. Send one-time invoices

If you don’t collect rent on a recurring monthly basis, you can send a one-time invoice instead. This works well for salon chairs, billboards, camping sites, or other units that are typically rented for a one-time use. You can choose which bank account you’d like to receive payments, as well as assign the invoice to a specific property or portfolio.

3. Accept partial payments

Some rental businesses, like salons, may prefer their renters make weekly payments instead of monthly. With partial payments, you can allow your renters to submit up to four payments toward a single invoice. Business owners can choose to enable this feature for all invoices or an individual invoice. Note that while the first payment toward an invoice is free for renters, all subsequent payments toward that same invoice incur a $4.99 fee.

4. Charge one-time fees

Azibo gives rental business owners the flexibility to charge one-time fees in addition to rent costs. These may include fees for applications, cleaning, late payments, mileage, or amenities that require an incremental charge.

Going beyond residential real estate with Azibo

Azibo was built for all kinds of landlords — whether you own a residential property, commercial property, billboard, parking lot, storage unit, or other type of rental business. Our tools and features help rental business owners save time, stay organized, and achieve their financial goals. Learn more about Azibo’s free, one-stop-shop financial platform today.

Important Note: This post is for informational and educational purposes only. It should not be taken as legal, accounting, or tax advice, nor should it be used as a substitute for such services. Always consult your own legal, accounting, or tax counsel before taking any action based on this information.

Whether you’re a property owner, renter, property manager, or real estate agent, gain valuable insights, advice, and updates by joining our blog.