Is Azibo Really Free for Landlords?

In short, yes! In this blog post, we share the answer to one of the most common questions we receive from landlords.

%5B1%5D.webp)

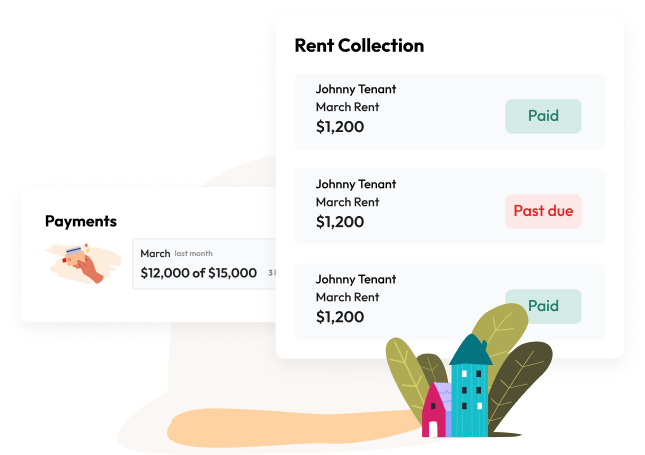

Azibo is a unified property management platform for real estate investors. It is the simplest way to manage rental properties and their finances, with solutions for rent collection, tenant applications and screening, accounting, insurance, and more — while also providing an excellent tenant experience embedded into one convenient place.

This enables landlords to manage their entire rental business in one platform, with one login — and get access to Azibo’s core features for free.

Azibo’s offerings: An overview of free and paid features

Here is a breakdown of Azibo’s free and paid offerings:

Core Azibo products (free for landlords)

Azibo’s core products are free for landlords:

- Online rental applications

- Tenant screening*

- Online rent collection (via ACH transfer, debit card, or credit card**)

- Financial management and banking

- Real estate accounting (including income and expense management, financial reports, and tax prep tools)

- Bill pay (one-time payments to vendors)

*Azibo tenant screening services are free for landlords, but prospective renters undergoing a background check through Azibo pay a one-time fee of $39.99 per application.

*Tenants who choose to pay rent via debit or credit card through Azibo are charged a 2.99% transaction fee.

Optional paid Azibo features for landlords

We also offer additional services that landlords can choose to purchase (or not):

- Lease agreements and eSigning: Customize state-specific lease agreements and leverage our electronic signature service for $29.99 per lease.

- Insurance: Get a free quote and then choose whether to purchase landlord insurance (plus optional policies like umbrella insurance or loss of rent coverage), as well as the option for tenants to purchase residential renters insurance through Azibo.

Azibo offerings for renters (free and paid)

Our platform helps landlords provide value to their tenants through flexible payment methods, competitive insurance policies, and rent reporting.

- Online rent payments: Tenants can choose to pay rent via ACH transfer for free, or use a debit or credit card for a 2.99% transaction fee.

- Renters insurance: Tenants can get a free quote and choose from affordable options for residential renters insurance policies.

- Rent reporting: For $4.99 per month, tenants can add on Azibo Credit Boost, which helps improve their credit scores by reporting on-time rent payments to the three major credit bureaus.

Enjoy a “no commitment, no contracts” policy

We understand that every real estate investor’s journey is different, so we want to offer a flexible solution that works for your unique needs.

With that in mind, we have a “no commitment, no contracts” policy. That means landlords don’t have to sign any contracts or make any commitments to use Azibo. We encourage landlords to sign up and try it out to see if it’s the right fit for your rental business.

If it’s free, how does Azibo make money?

One of the most common questions we get from landlords is, “How can Azibo offer all of this for free? It sounds too good to be true!”

Our mission at Azibo is to level the playing field for independent landlords who are up against institutional investors with access to more resources. That’s why we provide free financial tools to help landlords save time, stay organized, and grow their business.

So rather than charging fees like traditional banks and software companies, Azibo makes money in other ways in order to provide our platform and tools at no cost to landlords.

Here are the primary ways that Azibo makes money:

1. We earn interest on cash balances.

Like most banks, we earn interest on cash deposits in Azibo bank accounts. However, unlike traditional banks, landlords can earn 3.75X the national average interest rate on their cash with an Azibo bank account. Our accounts also have zero monthly or hidden fees and no minimum balance requirements.

2. We take a small convenience fee on debit and credit card transactions.

Azibo provides flexible online payment options for landlords to pay bills and tenants to pay rent. You can make payments through Azibo for free using an ACH bank transfer. Or, if you or your renter wants to pay using a credit or debit card, Azibo charges a 2.99% transaction fee.

3. We offer optional paid features.

As stated above, Azibo offers additional features beyond our core products for landlords and renters. These optional features include: Lease agreements and eSigning, Insurance (for landlords and renters), Credit Boost rent reporting (for tenants), and tenant screening (paid by the tenant applicant).

4. We earn commissions when you buy products from our partners.

We make a commission if you use Azibo to buy products from our insurance partners, or other companies we’ve teamed up with through the Azibo Marketplace — which offers exclusive offers for real estate services like loans, maintenance, legal services, and more.

Leveling the playing field for independent rental property owners

At Azibo, we believe in more than just cost-effectiveness. We want to create a level playing field where independent landlords aren't overshadowed by big institutional investors. By providing our core services for free, we're giving landlords the tools they need to effectively manage and grow their rental business.

This vision is at the heart of everything we do and is the driving force behind our innovation.

It's not just about getting something for free — it's about moving your real estate investment forward with the support of a partner who's committed to your success.

If this all sounds good to you, we’d love for you to join the Azibo community. Sign up today and enjoy Azibo’s core products for free.

Important note: This post is for informational and educational purposes only. This post should not be taken as legal advice or used as a substitute for such. You should always speak to your own legal counsel before taking action.

Whether you’re a property owner, renter, property manager, or real estate agent, gain valuable insights, advice, and updates by joining our blog.