8 Tips for Building a Profitable Rental Property Portfolio

Learn what first-time rental property buyers need to know before taking the leap into rental property investment.

Every month, new landlords enter the real estate market to build their assets and earn rental income. However, stepping into this field for the first time can be challenging and intimidating for new property buyers. And even experienced homeowners agree that purchasing a property to live in is vastly different than purchasing a property.

From finding the right property, choosing the best tenant, staying on top of rent collection, to properly filing taxes, rental property owners have to manage many details. Here are some of the most important things that first-time rental property buyers should know in 2022.

What rental property buyers need to know

1. Have the right mindset towards your investment

First-time buyers often look at a rental property purchase in the same way they view the purchase of their homes. This can lead to numerous mistakes in the handling and management of the property.

First-time investors must learn to look at their rental properties as assets and investments to be managed prudently and with care. Property owners are not simply home owners, they are business owners who must treat renters as valued customers and properties as important assets.

2. Choose your first tenants wisely

Tenants are often the deciding factor in how stressful the experience of renting out a property can be for first-time owners. Tenants that pay on time, maintain communication with owners, and treat the property with respect and care can make it significantly easier for property owners to learn and grow in the business.

This is why it is important for property owners to understand the profile of their first renter. An effective tenant screening process can help landlords ensure their first renter does not have a history of defaulting on rent payments or breaking their lease before its end.

3. Remain compliant with the latest laws and regulations

Like any other business, rental properties are subject to ever-changing laws and regulations. The first thing landlords should do is familiarize themselves with the laws and regulations that apply to their state and property type. Once property owners are familiar with these laws, it is important they stay up-to-date regarding regulatory changes across lease periods and renewals.

4. Set an appropriate starting rental price

Although rental prices are always changing and fluctuating, take the time to determine an appropriate price for your first tenant. New rental property owners can do this by searching the average rental price in the state, matching prices with similar properties in the neighborhood, and assessing the value that their property can uniquely provide.

Choosing the right price in the early stages also makes it easy for landlords to rely on renewals and minimize turnover — ensuring a steady, fair income from long-term tenants.

5. Adjust your rent according to the latest market conditions

As the industry landscape and tenant preferences evolve, rental property owners must remain flexible. The effects of the COVID-19 pandemic have underlined the importance of understanding and responding to changing market conditions to ensure revenue continuity. This means that landlords should always be aware of how similar properties in the area are adjusting rent prices, as well as how much tenants are willing to pay during periods of economic uncertainty.

6. Ensure that your tenants are protected with renters insurance

There are many avoidable and unavoidable issues that can occur during the course of a lease. From unintentional damage to theft and injury, renters and landlords can find themselves footing the bill for a wide variety of problems. Landlords protect themselves from unplanned bills by holding a security deposit from tenants — and an average of 36.1% of landlords have had to use these security deposits to cover unforeseen costs.

In extreme circumstances such as an accident or fire on property, landlords could end up footing the bill and engaging in tedious administrative processes if tenants are unable to pay for damages. This is why it’s a good idea for landlords to require tenants to have renters insurance to cover these unpleasant scenarios.

7. Have reliable processes in place to get paid every month

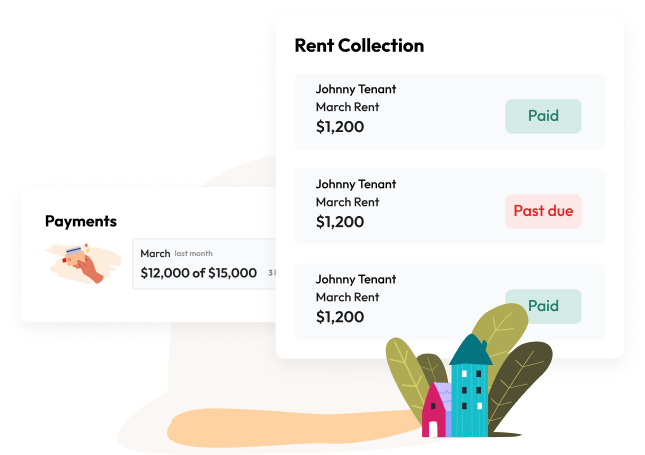

Rental property buyers often begin their investment journey as a way to generate additional income. However, landlords who don’t use modern software tools for rent collection are often faced with the hassle of chasing down tenants for rent each month.

As online payments become easier than ever, landlords should allow renters to pay in a way that is convenient for all parties involved. This could mean allowing tenants to make simple bank transfers, set up recurring payments, use digital platforms designed for rent collection, or even pay rent with their credit cards.

8. Keep track of important documents with modern software

During the course of a lease, it’s critical for landlords to maintain a strong and positive relationship with their tenants. This relationship is often at its most strained when it is time to return the security deposit.

A recent survey revealed that 23.8% of renters believed that a landlord had unfairly held back a security deposit from them. This can be avoided by all parties keeping an accurate record of important documents relating to the lease in a convenient and consolidated location.

Build a profitable rental property business

These tips can get new landlords well on their way to building a profitable rental business. First-time rental property buyers have to wear multiple hats throughout this business venture. Between tracking finances, dealing with compliance paperwork, and monitoring an evolving rental market, earning a rental income can become overwhelming very quickly. Fortunately, the right software can help property owners offload these important but time-consuming tasks. Learn how Azibo’s all-in-one financial platform for landlords can help you manage your rental income more effectively.

Important note: This post is for informational and educational purposes only. This post should not be taken as legal advice or used as a substitute for such. You should always speak to your own legal counsel before taking action.

Whether you’re a property owner, renter, property manager, or real estate agent, gain valuable insights, advice, and updates by joining our blog.